Hamilton’s Industrial Market is in Transition

Need the highlights at a glance?

Download the Market of the Month Cheat Sheet →

Hamilton’s industrial market is undergoing a notable shift in 2025, shaped by a dynamic mix of new development, evolving tenant demand, and increased market caution. Over the past several years, Hamilton has emerged as a key logistics and industrial hub in Southern Ontario, thanks to its strategic location, affordability compared to the GTA, and direct connectivity to major transportation routes. But while the fundamentals remain strong, various segments of the market are beginning to show signs of a transition—finding a balance between long-term growth and near-term uncertainty.

Development Momentum Meets Market Caution

One of the most significant drivers of Hamilton’s industrial evolution is ongoing development in key submarkets like Ancaster and Stoney Creek. These areas have attracted sustained investment, with a healthy pipeline of both speculative and build-to-suit industrial projects catering to logistics, manufacturing, and general warehousing users. This has boosted the region’s total inventory and provided much-needed space options in recent years. However, supply-side dynamics are beginning to shift.

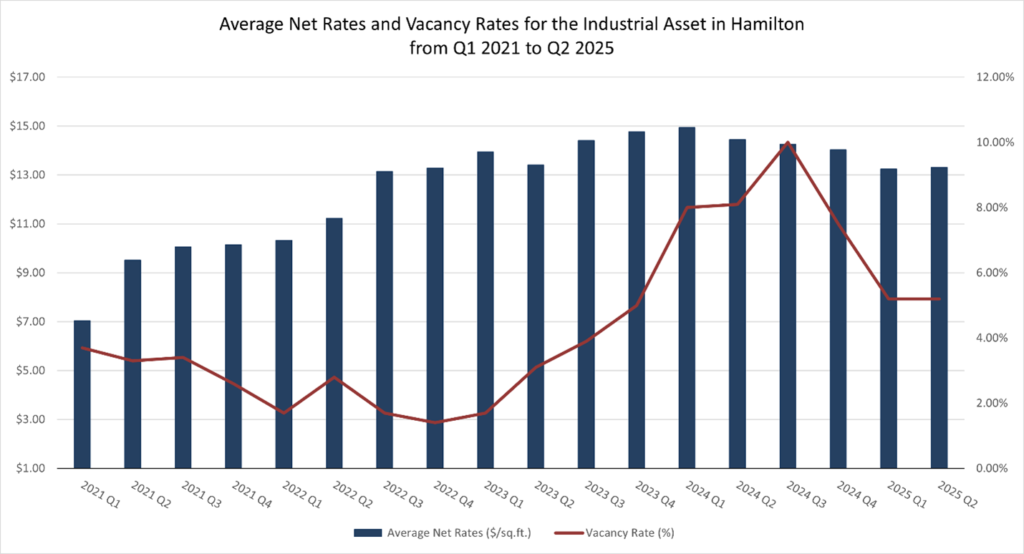

Vacancy in Hamilton has ticked upward from historically tight levels, hovering around 3.00%. The increase is primarily due to slower lease-up times for large-bay facilities over 100,000 square feet, many of which have become available over the past 12 to 18 months. In submarkets like Stoney Creek and Ancaster, larger speculative buildings are lingering on the market longer than expected, contributing to higher availability.

This shift has caused many developers to recalibrate their strategies. Where speculative building was previously widespread, riding the momentum of pandemic-era demand and low vacancy, today’s approach is more cautious. Developers are becoming more selective, prioritizing projects with secured tenants or strong pre-leasing commitments before moving ahead. Several planned developments have been paused or scaled back. This conservative stance is further reinforced by economic uncertainty, tighter borrowing conditions, and rising construction costs.

Mind the Gap: Supply Imbalance by Unit Size

As a result, we’re seeing a growing imbalance in supply across different segments of Hamilton’s industrial market. While there is a relative surplus of large-format space in outer submarkets, mid-sized industrial units, specifically between 20,000 and 60,000 square feet, are challenging to come by. This mid-bay segment, which remains in high demand among local businesses and service-driven industrial users, has become one of the most constrained portions of the market. Limited new construction targeting this size range has created a supply gap, pushing tenants to expand searches or compromise on building features. Reinforcing this situation, recent shifts along Rymal Road highlight a broader trend where industrial lands are being redeveloped for commercial, retail, and mixed-use purposes. This transition reduces the availability of traditional industrial spaces, particularly mid-sized units, as redevelopment increasingly prioritizes retail and residential uses over new industrial construction.

As of mid-2025, average industrial lease rates in Hamilton range from $13.00 to $16.00 per square foot net, depending on building quality, age, and location. Submarkets like Ancaster and Stoney Creek, where larger new inventories are located, tend to see lower average rents. In contrast, Hamilton’s urban core continues to command premium rates as space remains scarce and demand resilient.

To boost leasing activity, landlords are increasingly utilizing tenant improvement (TI) allowances and flexible lease incentives. This trend is also observed in recent Landmark transactions.

What Tenants Can Expect on Rates, Incentives, and Land Costs

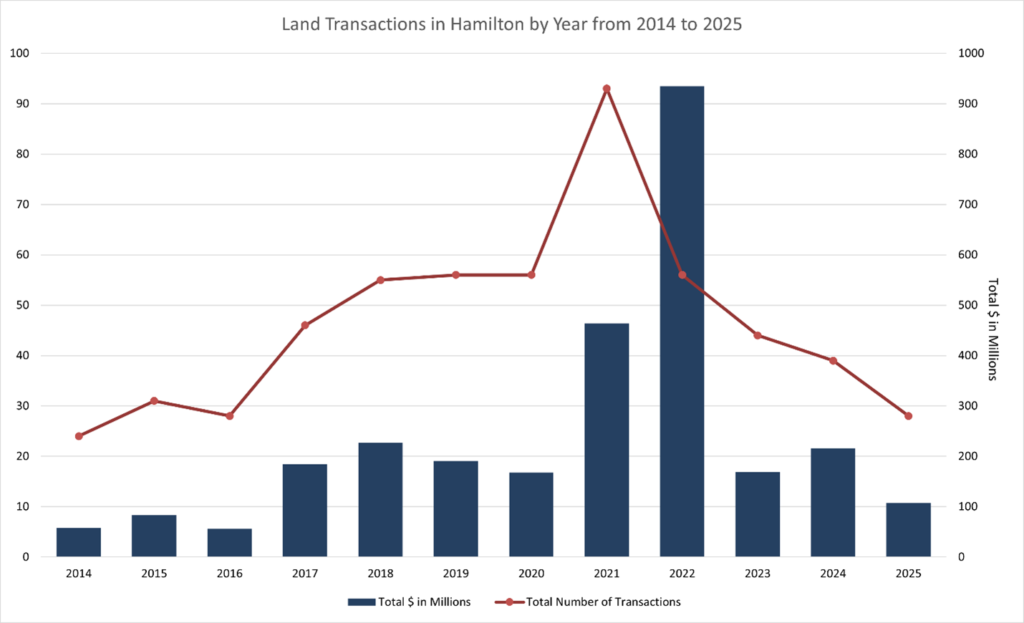

Land sales also reflect the broader market recalibration. Land values in Hamilton’s industrial areas, previously escalating rapidly, have now softened. Transaction activity has slowed as developers take a wait-and-see approach, holding off on acquisitions until market fundamentals improve and absorption catches up. This cautious investment mindset is echoed across much of the Golden Horseshoe, but Hamilton’s ample land base remains a long-term advantage for future development once conditions stabilize.

Looking Ahead: What CRE Tenants Should Watch in Hamilton

Looking ahead, Hamilton’s industrial market is expected to remain undersupplied for certain user categories, despite the recent rise in overall vacancy. Mid-bay users will continue to face limited options into the near term, with few new projects geared toward this segment and little flex warehouse product available. On the other hand, large-format space will likely continue to absorb slowly, especially in areas seeing an influx of new speculative builds.

As developers delay or reduce construction pipelines, Hamilton should see a gradual stabilizing of vacancy levels over the medium term. However, the recovery in leasing velocity, particularly for larger industrial footprints, may take time and rely on further improvements in macroeconomic confidence and tenant expansion plans.

In summary, Hamilton’s industrial market continues to evolve. While still anchored by strong demand and long-term fundamentals, the current environment is more nuanced. There is an increasing need for tailored development, tenant-focused leasing strategies, and targeted land use planning to address growing disparities between market segments. For investors, tenants, and developers alike, success will hinge on understanding and adapting to these new dynamics.

Need the highlights at a glance?

Download the Market of the Month Cheat Sheet →

Looking to lease industrial real estate in Hamilton? Our tenant-focused advisors are here to help you navigate the market with tailored insights and on-the-ground expertise.

Our Market Intelligence team is committed to helping you stay ahead of the curve by identifying key trends that maximize both space and operational efficiency. With customized insights grounded in real-time data and extensive industry expertise, we ensure you’re equipped to make informed decisions in this competitive market.

Estephany Cruz Sanchez

Market Research Analyst

Estephany has been part of Landmark Advisory Services since 2022 and is an integral part of our Team.