Gateway Growth & Opportunity in 2025

Need the highlights at a glance?

Download the Market of the Month Cheat Sheet →

Winnipeg’s commercial real estate (CRE) market is navigating a period of transition in 2025. While the office sector grapples with post-pandemic adjustments, the industrial market remains robust, driven by strategic location and infrastructure developments.

Winnipeg’s Commercial Real Estate Momentum

Several factors are converging to make Winnipeg an increasingly strategic hub for commercial growth in 2025:

- Winnipeg’s location at the crossroads of Eastern and Western Canada, combined with strong transportation links to the United States, continues to support industrial and logistics demand.

- Major infrastructure initiatives, including expansions at CentrePort Canada and new industrial districts like the Water Tower District, are enhancing the city’s appeal to distribution, manufacturing, and e-commerce tenants.

- The office market is slowly stabilizing, with suburban Class A buildings seeing the strongest activity as tenants adapt to hybrid work models and prioritize quality, accessible spaces.

- Investment in mixed-use and industrial developments signals confidence in Winnipeg’s long-term growth, attracting both local and national tenants.

For businesses and real estate decision-makers, the key isn’t just observing these trends—it’s aligning your leasing strategy with where the Winnipeg CRE market is heading.

Industrial Market: Strong Demand and Limited Supply

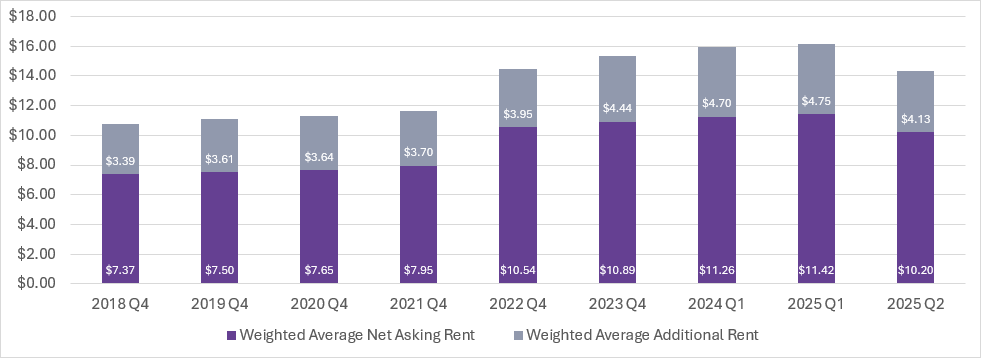

Winnipeg’s industrial market remains highly competitive in 2025, with overall vacancy at just 2.7% overall (North: 3.0%, South: 3.1%) and average net rents ranging from $9.50 to $12.50. Historically a stable market, Winnipeg has experienced notable increases in asking rents over recent years, driven by strong demand and limited supply. While rental rates continue to rise, the pace of growth has moderated since 2024 and is expected to remain steady throughout 2025. Rental rates for new construction, however, continue to fluctuate amid economic uncertainty.

The city’s industrial appeal is driven by:

- Trade advantages: Access to NAFTA, CETA, CKFTA, and CPTPP enhances distribution efficiency.

- Strategic location: Central Canada gateway with strong U.S. connections.

- Infrastructure: Major highways, rail, and a busy cargo airport.

Key development areas:

- Northwest Quadrant: CentrePort Canada – FTZ benefits, lower taxes, and modern infrastructure.

- Southwest Quadrant: Refinery District and McGillivray Business Park – convenient highway access and modern facilities.

- Southeast Quadrant: Water Tower District, Plessis Business Park, and The Waters Business Park – shovel-ready industrial sites with strong infrastructure.

- Northeast Quadrant: Limited activity; focus remains on West and South hubs.

Industrial tenants benefit from Foreign Trade Zone programs, Manitoba’s low business costs, skilled workforce, and supportive community—making Winnipeg a strong option for logistics, manufacturing, or e-commerce operations.

Office Market: Stabilizing Amidst Change

The Winnipeg office market is still adjusting, with vacancy elevated but showing early signs of stabilizing.

- Vacancy Rates: Southwest sits at 15–17%, while Northwest averages 12–14%, both above pre-pandemic levels.

- Rental Rates (Net):

- SW Class A: $18–$22/sf | SW Class B/C: $12–$16/sf

- NW Class A: $16–$19/sf | NW Class B/C: $10–$14/sf

- Leasing Activity: Net absorption remains flat to negative, with more space returning to market than being leased. Most demand is for smaller suites under 5,000 sf, as larger tenants continue to downsize or consolidate.

- Trends: Hybrid work is reducing overall office footprints, tenants are upgrading to newer amenity-rich properties, and suburban locations remain attractive for accessibility and lower costs. Some older assets are being repurposed for medical, residential, or light industrial uses.

Looking ahead, vacancy is expected to remain elevated through 2025, with gradual improvement as the market works through excess supply. Class A suburban offices with strong amenities are best positioned to perform, while older stock will face continued challenges.

Key Takeaways for Commercial Real Estate Tenants

For tenants in Winnipeg: the office and industrial markets are presenting very different opportunities. Office vacancy is high but stabilizing, particularly in suburban Class A buildings where tenants can secure modern, well-located space with flexible terms. Meanwhile, industrial properties are tight, and competition remains strong, particularly in strategic hubs like CentrePort and the Water Tower District. Aligning your leasing strategy with these market realities—understanding where demand, incentives, and infrastructure intersect—will position your business to take advantage of Winnipeg’s evolving CRE landscape in 2025.

Need the highlights at a glance?

Download the Market of the Month Cheat Sheet →

Looking to lease industrial real estate in Winnipeg? Our tenant-focused advisors are here to help you navigate the market with tailored insights and on-the-ground expertise.

Our Market Intelligence team is committed to helping you stay ahead of the curve by identifying key trends that maximize both space and operational efficiency. With customized insights grounded in real-time data and extensive industry expertise, we ensure you’re equipped to make informed decisions in this competitive market.

Charl Valbonard

Senior Market Research Analyst

Charl has been part of Landmark Advisory Services since 2022 and is an integral part of our Team.